28+ Accelerated mortgage payment

C down payment of 35 and up. You can also use the calculator on top to estimate extra payments you make once a year.

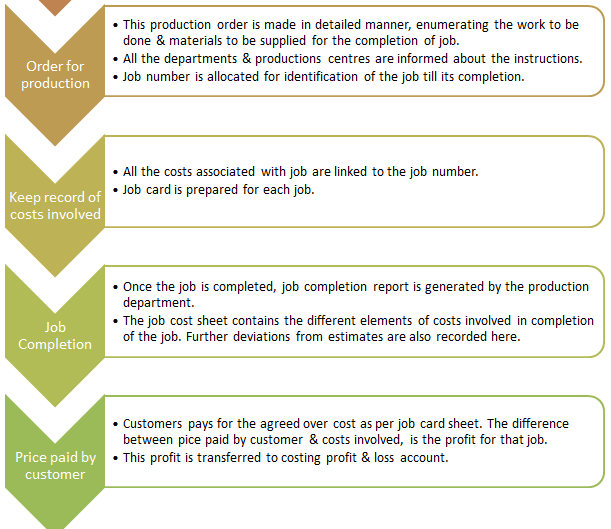

Job Costing Complete Guide On Job Costing In Detail

The following example shows how much time and money you can save when you make a 13 th mortgage payment every year starting from the first year of your loan.

. Fixed Versus Adjustable Rate Loans. Dont worry you can edit these later. To try experimenting with lump sum payments select an amount in the yearly payment summary above under Yearly Mortgage Breakdown Lump Sum Payments.

Home Capital jumped 95 to C3116 as of 108 pm. Calculate your mortgage payment schedule and how to save money by making prepayments. 30-Year Fixed Mortgage Principal Loan Amount.

RP Funding offers you the best deal on a Florida mortgage with our Closing Cost Programs and No Lender Fees. Email EN Sign In. The calculator lets you determine monthly mortgage payments find out how your monthly yearly or one-time pre-payments influence the loan term and the interest paid over the life of the loan and see complete.

Most banks offer some form of mortgage payment deferral to help homeowners during difficult financial periods. The portion of your payment that goes toward principal and interest. You will therefore make 26 payments a year the equivalent of one extra monthly payment a year.

Freddie Macs 2016 home buyer statistics published on April 17 2017. We offer payment schedules and options to fit your lifestyle and goals. 060 of the estimated value of the property.

By understanding the impact that interest has on your payment every. Such as by changing from a monthly payment to an accelerated bi-weekly payment then your amortization period will decrease. May 28 2019 at 536 pm.

Lump sum payments can have a dramatic effect on the amount of interest you pay and on the length of your amortization. To try it select Biweekly accelerated as your payment schedule above. Scotiabank Mortgage Calculator allows you to calculate your mothly mortgage payments and cash required for real estate purchases using current Scotiabank rates.

Check with your mortgage. Type of acceleration - The mortgage acceleration calculator offers three ways to calculate the result. 2021-29 2022 Home Equity Conversion Mortgage HECM Limits.

Electronic Appraisal Delivery EAD Module. When taking out a mortgage loan you might be interested in knowing how much money you are actually paying for every thousand dollars you borrow. Where moratorium is available for payment of interest payment of interest becomes due only after the moratorium or gestation period is over.

With fixed periodic total payment and interest amount the principal repayment is also constant over the life of the loan. Marcus by Goldman Sachs currently has highly-competitive interest rates at 599 APR to 2899 APR for non-New York residents and 599 APR to 2499 APR for New York residents with payment terms ranging from 36 months to 72 months. For example the accelerated bi-weekly payment allows you to pay half of your monthly payment every two weeks.

Extra Payment Mortgage Calculator By making additional monthly payments you will be able to repay your loan much more quickly. A fixed rate mortgage offers a specific interest rate that is fixed or locked-in for the term of the mortgage. The Web Automated Reference Manual System WARMS includes manuals directives handbooks Title 38 Code of Federal Regulations and more.

In Toronto the highest level since early May. To run the mortgage acceleration calculator you need to specify the following parameters for your mortgage loans. The main cost you need to worry about is your break of mortgage penalty known as the pre-payment penalty.

42121 In the case of bank finance given for industrial projects or for agricultural plantations etc. Marcus is also well-known for its five-minute application process and no-fee guarantee. That means youll know exactly what to expect including.

Apply Now Login Who is Robert Palmer. Mortgage payment is the amount that you will be. Skip to main content.

2021-27 Appraisal Fair Housing. Visit RBC Royal Bank to make the most of your renewal and understand your mortgage options. 2022-02 Technical Update to the Extension of the Deadlines for the First Legal Action and Reasonable Diligence Time Frame.

We believe privately-owned strategic players and private equity are the most likely suitors. The publications provide information about the Department of Veterans Affairs benefits policies. 2022-04 Update to the Mandatory Use Date for the Federal Housing Administration FHA Catalyst.

From 1963 to 2019 the median home price in the United States rose from 18000 to 321500 compounding at 528 annually. The declining-balance method is an accelerated method of amortization where the periodic interest payment declines but the principal repayment increases with the age of the loan. Loan amount - Either the remaining balance or in the case of a new loan give the original loan value.

While there is definitely a strong potential to save even more money in the future by making accelerated mortgage. 240 of the estimated value of the property. A down payment of 20 to 2499.

This penalty is charged by your lender for breaking your mortgage. Were proud to offer competitive rates to our mortgage clients. Comparing auto loans vs.

UFMIP funding fees the payment of a mobile notary fee if the selected closing. B down payment of 25 to 3499170 of the estimated value of the property. A Partner You Can Trust.

The interest rate of your mortgage. Required to pay based on your mortgage terms. From a mathematical standpoint we can conclude that the loan with 1 the higher interest rate and 2 the longer payment period will be the one youll want to accelerate.

The amount of your regular mortgage payments. Use the popular selections weve included to help speed up your calculation a monthly payment at a 5-year fixed interest rate of 5540 amortized over 25 years. This calculator assumes that no premium is charged when the down payment is over 20.

Get to the closing table in as little as 10 days with our Accelerated Closing Program. Quickly See What Your Mortgage Payments Might Look Like. We are dedicated to helping our clients reach their home buying dreams.

On a fixed rate mortgage the interest rate remains the same through the entire term of the loan rather than the interest rate doing what is called float or adjustWhat characterizes a fixed rate mortgage is the term of the loan and its interest rate. 4212 Loans with moratorium for payment of interest.

Pin On Self Defense Pepper Spray

Dna Technology Logo Genetic Dna Technology Biology Logo Sponsored Technology Dna Logo Biology Genetic Ad Dna Technology Technology Logo Biology

Budget Calculator Budget Planner Mls Mortgage Budget Calculator Budgeting Amortization Schedule

Pin On All About Money

Velocity Banking Calculator Demo Spreadsheet Template Banking Spreadsheet

Http Vs Https Certificate Authority Online Security Cyber Security

Redeemable Preference Shares When Preference Shares Be Redeemed

People Can Buy A House Through Bukalapak App Mortgage Loans Canning Start Up

Real Estate Sales Quotes Quotesgram Real Estate Sales Real Estate Quotes Sales Quotes

7 Ways To Get Attention On The Internet And Annoy Everyone In The Process Web Marketing Informative Blog Social Media

Accelerated Reader Ideas Elementary Librarian Goal Thermometer Templates Goal Thermometer Fundraising Thermometer Templates

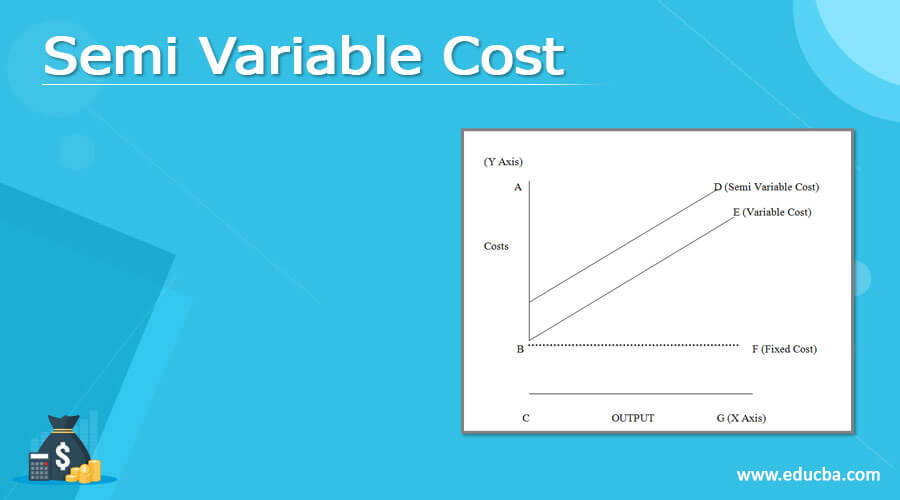

Semi Variable Cost Examples And Graph Of Semi Variable Cost

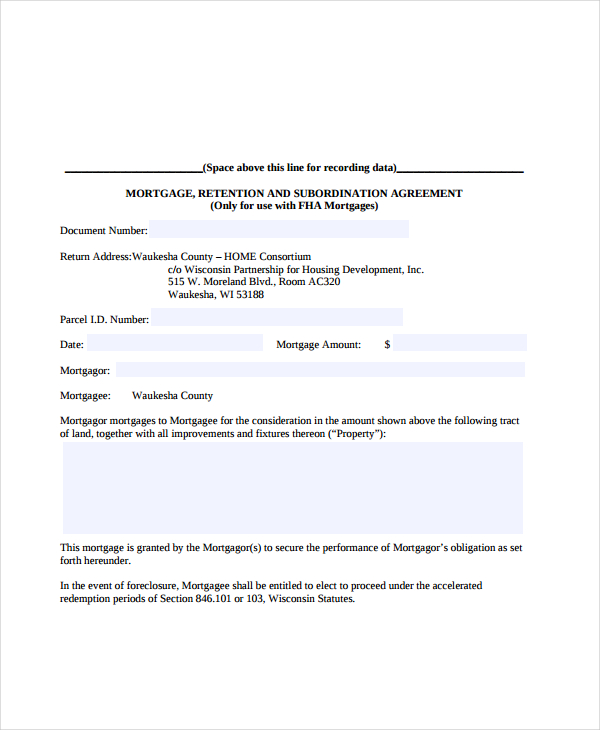

12 Retention Agreement Templates Pdf Doc Free Premium Templates

What Should I Be Looking For In Life Insurance Life Insurance Marketing Ideas Life Insurance Facts Life Insurance Marketing

Job Costing Complete Guide On Job Costing In Detail

Free Printable Mortgage Commitment Letter Legal Forms Doctors Note Template Legal Forms Letter Form

Operating Cash Flow Ocf Cash Flow Statement Positive Cash Flow Cash Flow